AIA Ohio Latest News

AIA Ohio Award Winners

Congratulations to the 2023 AIA Ohio Honor Award and AIA Ohio Design Award Recipients!

AIA Ohio Latest News

Legislative Alert – Ohio Special Election

Protect Ohio’s Ability to Fund Construction Bonds Vote No on Issue 1 This document is for general information purposes and should not be regarded as legal advice. Readers should not act on information contained in this newsletter without seeking legal counsel. On...

AIA Ohio Member Advisory on SB56

Limitation of Liability for Ohio Design Professionals A Legislative Update January, 2023 This document is for general information purposes and should not be regarded as legal advice. Readers should not act on information contained in this newsletter without seeking...

RFP – Fire Station 1 Expansion | Marietta, Ohio

The City of Marietta, Ohio is seeking Statements of Qualifications from qualified Architectural and Engineering firms with respect to design services, bidding assistance, and construction administration for an expansion to Fire Station #1 located in Downtown Marietta....

AIA Ohio’s Payment Assurance Legislation

SB 49, AIA Ohio's Payment Assurance Legislation, was officially signed into law on July 1, 2021, in Governor DeWine's office at the Ohio Statehouse. First introduced as SB136 in 2019, the bill took two legislative sessions and a lot of work by AIA Ohio's Payment...

AIA Ohio Events

Need an Architect?

Find an AIA architect in your area

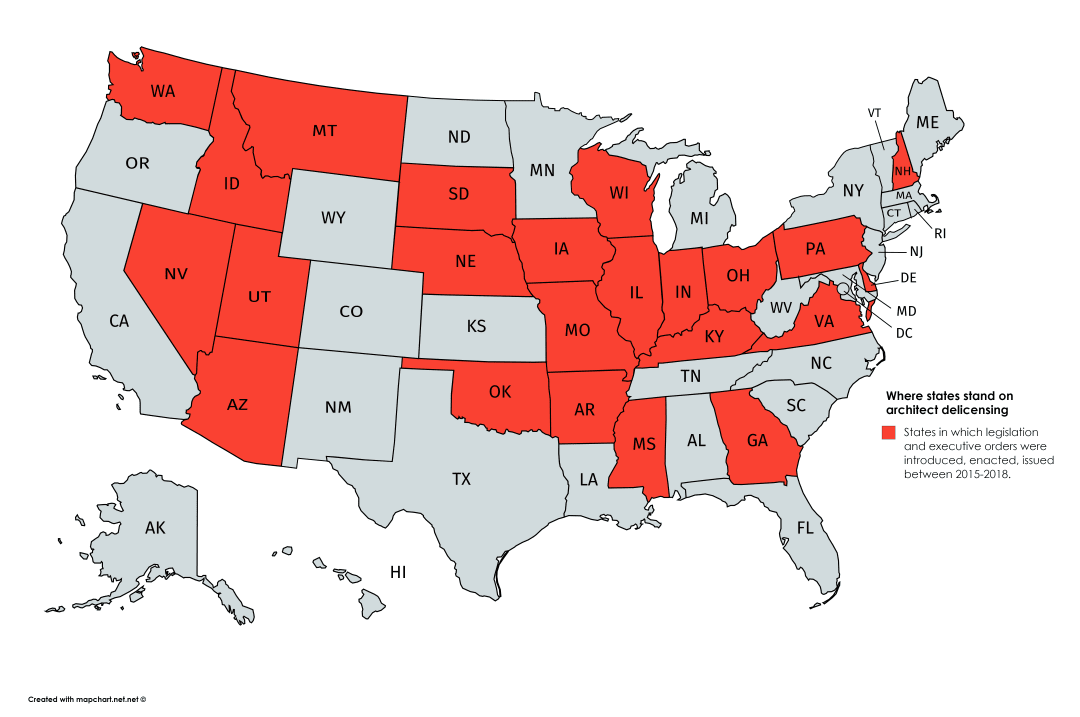

Where We Stand: Professional Licensure

Architects issue statement on how licensing protects the public Read More